An intranet is what your credit union needs to improve employee experience and address industry challenges head on. This post explains how intranets can benefit credit unions by improving customer service, cutting costs, ensuring compliance with regulations, and more.

If you’re operating a credit union today, you face several challenges. In a world dominated by behemoth, for-profit financial institutions, credit unions are doing what they can to serve their communities and provide the best rates for their members. Budgets are limited, but members expect a high level of service. You may find it difficult to remain competitive with large banks in attracting and retaining customers. There are also staffing challenges to face, such as high employee turnover and the need for fresh ways to keep workers engaged. On top of that, you have strict, often-changing regulations to comply with, and information security is paramount.

The good news is that an intranet can give your credit union the tools it needs to tackle these challenges head-on. It can help you improve performance, cut costs, better serve members, ensure security, keep up with compliance needs, reduce employee turnover, and more. An intranet is one workplace asset with a major return on investment. Here are six key reasons why.

- 1. Intranets help credit unions cut costs

- 2. A credit union intranet improves customer service

- 3. An intranet streamlines your credit union’s technology

- 4. Intranets can boost employee engagement for credit unions

- 5. An intranet will help your credit union retain staff

- 6. A credit union intranet promotes compliance

- Credit union intranets: A force for connection and collaboration

Discover how to plan and implement a modern intranet with our complete guide.

1. Intranets help credit unions cut costs

Perhaps more than any other financial services provider, it’s essential for credit unions to maximize cost efficiency. Big banks have big budgets, making it easy for them to offer competitive pricing. Because your credit union operates on a nonprofit basis, with a member-first mindset, you need to be more careful with your resources. This means finding solutions that cut costs without sacrificing the level of service that keeps your members loyal.

An intranet saves your employees time by streamlining collaboration and information-sharing. The right credit union intranet solution allows for centralized, searchable content, available to staff in seconds, and simplified collaboration across departments and teams. Research shows the average knowledge worker spends two hours a day searching for the documents, people, and information they need to do their jobs. Imagine the cost that creates for your credit union—and the possibility of reclaiming it through easy, centralized access to people and resources.

Another way an intranet can save your credit union time (and therefore, money) is by extending self-service beyond search and into tasks.

A self-service intranet allows employees to complete routine administrative tasks on their own, decreasing the burden on departments like HR and IT. The ability to streamline tasks such as requesting time off, submitting expenses, or accessing pay stubs can save hundreds of hours of workload, decreasing your overall expenses.

2. A credit union intranet improves customer service

Your members are what set you apart from large, faceless financial institutions. They prefer a human touch and have likely selected your credit union for the strong community feel and customer service you provide. To keep these members loyal, everything you do needs to communicate to them that you value their business and have their best interests at heart. This is no small task, but an intranet can help.

Discover how to plan and implement a modern intranet with our complete guide.

When employees have exactly what they need to do their jobs effectively, it leads to improved customer service. According to research by the Harvard Business Review, retail stores that focus on better employee experience performance could increase their revenue by over 50%.

An intranet for your credit union can go a long way in boosting employee experiences, which makes it easier for them to provide top-notch support to clients.

Credit union intranets offer centralized, up-to-date, and searchable content that covers everything from processing large transactions to opening and closing accounts. It can also provide clear guidance for processes that may come into question, like when to escalate an important task to a supervisor or transfer it to a different department.

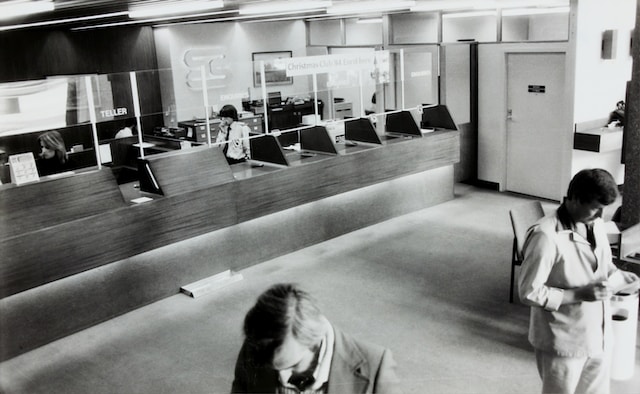

Whether they’re at the teller’s window or on the phone with member services, customers want the right answer, right away. An intranet enables your employees to provide that answer, confidently and accurately, or get the customer help from someone who can.

3. An intranet streamlines your credit union’s technology

Is your technology setup a little…clunky? The average organization uses 89 apps, an increase of 24% since 2016.

Although you may be able to eliminate some of your apps, it’s not realistic to abandon them all. However, your intranet can make the apps employees need easier to use. Switching back and forth between apps can be an efficiency-buster for employees—and with customer-facing employees like tellers, even a small delay can affect perceived levels of service. An intranet can integrate seamlessly with major business platforms and applications, providing one centralized hub for everything your employees need access to.

Discover how to plan and implement a modern intranet with our complete guide.

4. Intranets can boost employee engagement for credit unions

Your focus is already on personal connection and community. But that shouldn’t be limited to customers alone. Improving employee engagement is just as important to zero in on.

The research is indisputable—in addition to being more productive, more innovative, and more loyal, engaged employees also improve business outcomes—studies show that companies with higher engagement report 18% higher productivity and 23% higher profitability. Remaining competitive is a constant concern for credit unions, and raising employee engagement can make a substantial difference to your success.

An intranet drives employee engagement in a few different ways. One, which we touched on already, is making employees’ jobs easier by streamlining collaboration and providing easy access to the resources they need to get things done.

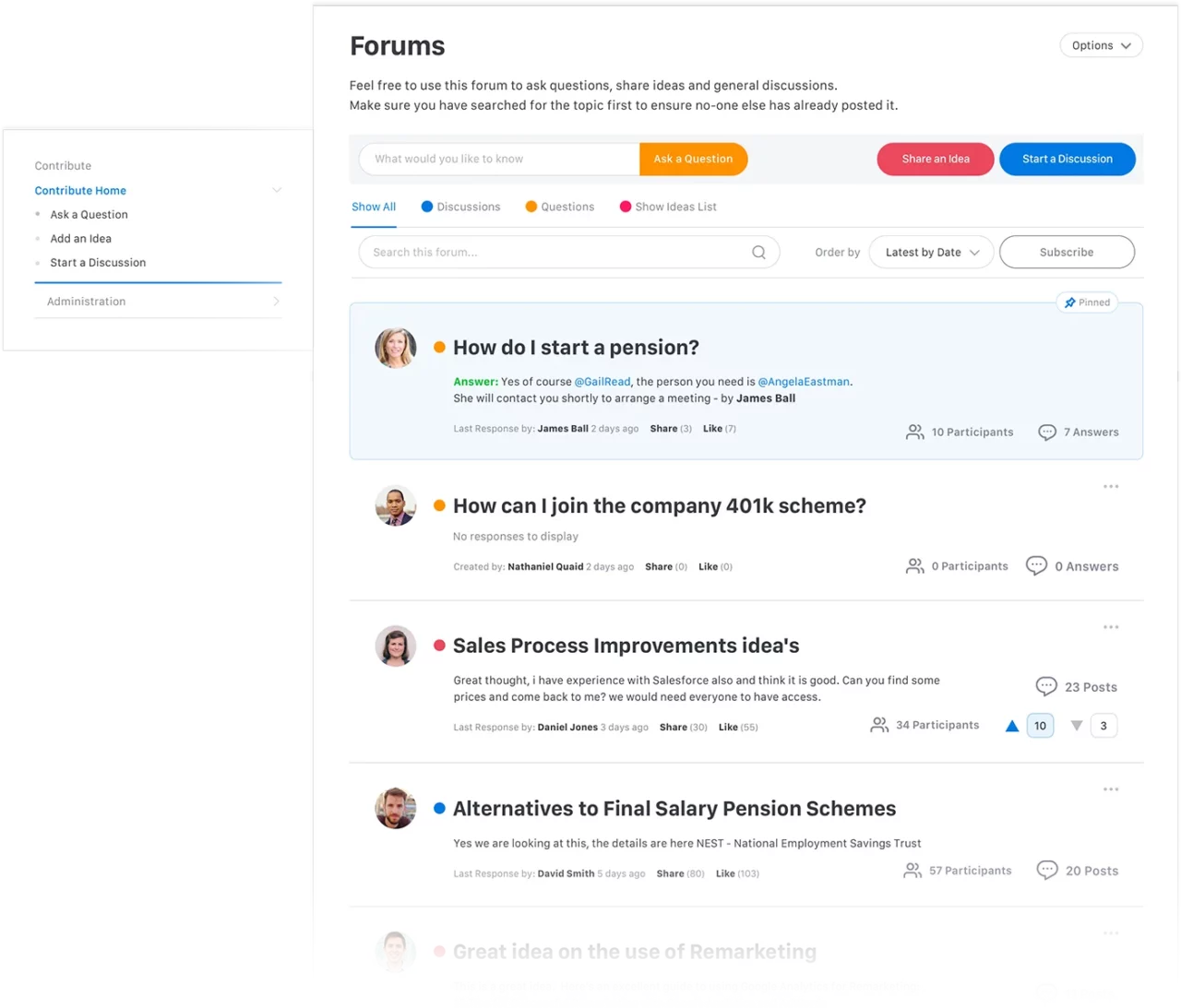

Another way an intranet boosts engagement is by creating a digital cultural hub that fosters meaningful connection. Your credit union’s intranet can be a place for conversation, community building, and value emphasis.

User-generated content and interactive features such as commenting, tagging, and sharing help employees connect with one another and promote a sense of belonging. Employee recognition features ensure that individual contributions are celebrated and rewarded. Top-down announcements and bulletins help users stay in the loop and get excited about company happenings.

As a credit union, you’re likely involved in your community or specific causes that matter to your members. This can mean participating in or hosting events or fundraisers. Employee buy-in is essential to the success of these initiatives. An intranet can be used to promote your event, recruit volunteers, and share successes through updates, recaps, and photos. The benefits of sharing on your intranet are twofold. You’ll increase traction for a worthy cause, and you’ll also help your employees connect to your mission, vision, and values. The pride and purpose they derive from being part of an organization that gives back will spark engagement and remind them why they love working at your credit union.

5. An intranet will help your credit union retain staff

Employee turnover is high across the board right now, and the financial services industry is no exception, with a 19% turnover rate. Finding replacements for departing employees isn’t easy and can take a huge chunk out of your budget. Challenges vary based on position, but whether you’re replacing a teller, CFO, or financial services representative, hiring is expensive and time-consuming. An intranet can help your credit union improve employee retention, reducing the time and resources spent searching for, hiring, and training new staff.

Discover how to plan and implement a modern intranet with our complete guide.

Your intranet can play a role right from the start of the employee lifecycle when deployed as an onboarding solution. As they begin a new role, employees can use your intranet as a resource to find information about processes, policies, trainings, and more. It connects them with the people they’ll be working with, both through a detailed people directory and access to community forums and groups. It also gives them a sense of your credit union’s values right away—the earlier this is done, the sooner they can start to identify with them and bring them into daily work.

6. A credit union intranet promotes compliance

You already know that compliance is key for banks, building societies, and other organizations in the financial services industry. To maintain accreditation your credit union needs an intranet that can help you stay on top of strict standards, which typically require frequent updates due to changing legislation.

An intranet can be an effective tool to ensure compliance with NCUA regulations, state laws, federal laws, and self-regulatory requirements. It makes it easy to update documents when standards, laws, or regulations change, and easy for employees to locate them once they’re updated.

Employees can search for and find what they need in seconds and know without a doubt that the information they have is current. Version-control features also allow you to audit content, maintain a trail of what’s been changed, and roll back to previous iterations if necessary.

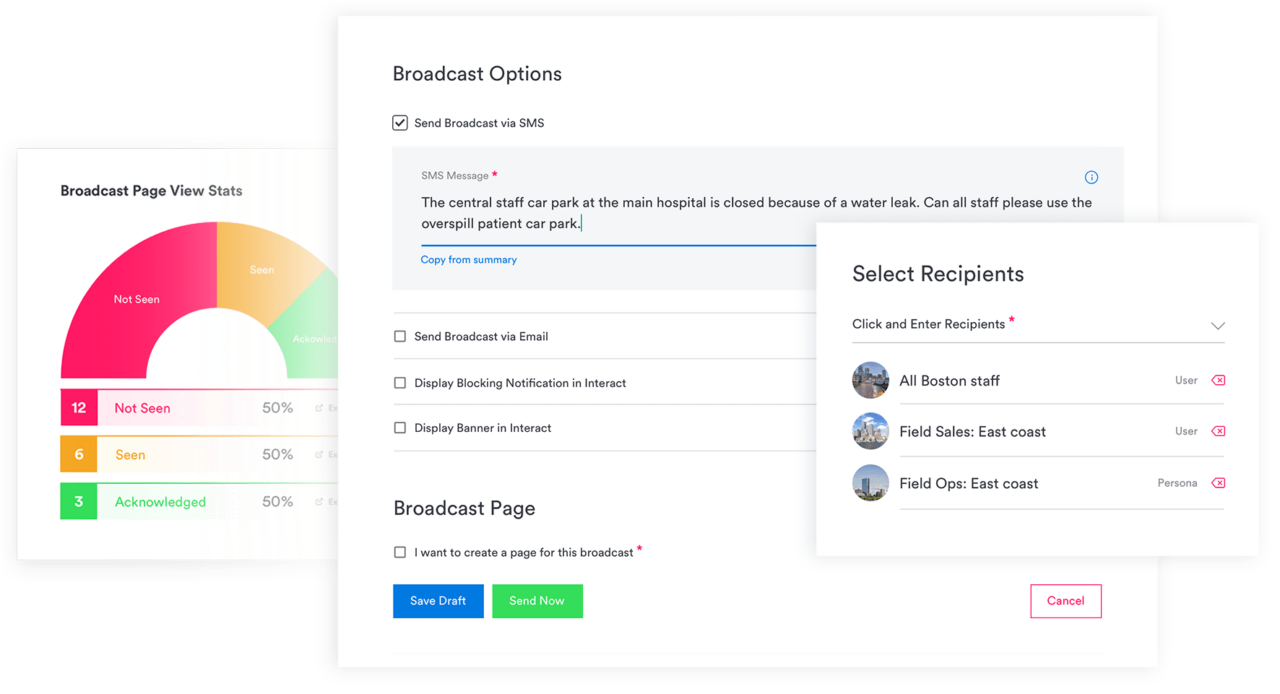

Automatically alerting staff to updated materials puts compliance front and center. A credit union intranet can broadcast important updates to employees across channels, from SMS to email to notifications on your intranet homepage.

“Mandatory read” features ensure employees have read what they need to read without any manual checking or chasing. Your intranet will record who has and hasn’t read essential content. If an employee hasn’t read a piece of mandatory content, your intranet can issue automatic reminders, and even block them from viewing less-essential intranet content until they’ve completed the task.

Credit union intranets: A force for connection and collaboration

Like many credit unions, you may have several locations throughout your region or even nationally. To maintain your reputation, it’s essential to keep everyone on the same page and deliver services that are up to the same standard across branches.

Intranets make it easy to collaborate and share knowledge, whether your employees are working different schedules, working from home, or working at different branches. Keeping all employees connected on a single digital hub facilitates collaboration and makes everyone feel they are part of one team.

An intranet can support all the differing functions and workstyles your credit union needs. Client-focused employees like financial advisors may need to securely access the digital workplace during off-site meetings. Front-line workers may benefit more from features like digital signage, which brings the intranet right into the physical branch location, showcasing need-to-know updates, culture initiatives, and even QR codes linking to relevant content.

A credit union intranet also bridges gaps and creates community among workers in distinct roles, whether they’re in front-line positions like tellers or branch managers, back-of-house positions like accounting specialists or HR associates, or even senior leadership positions. Where these roles may not have much day-to-day overlap in a typical office environment, an intranet allows for conversations and connection in a digital setting. Those in different positions can offer tips, guidance, and perspectives they might not otherwise share if not given a platform. This goes a long way towards encouraging innovative ideas, creating a sense of unity and belonging, and boosting employee satisfaction.